Under President Joe Biden’s leadership, the White House acted quickly to make necessary changes to the Paycheck Protection Program. The changes were implemented to better address the unique challenges and needs of small businesses and help them secure small business loans.

One of the more notable additions was made exclusive to businesses with 20 employees or less. Any small business that fits the employee head-count criteria was given an exclusive 14-day window to secure much-needed capital from small business loan lenders that participated in the PPP initiative.

The Paycheck Protection Program (commonly referred to as PPP) was a US Small Business Administration-backed program created under the Trump administration during the early days of the COVID-19 pandemic. It offered small business grants to entrepreneurs with specific incentives to maintain their workforce.

Instead of granting small business loans directly to struggling businesses, the PPP acts as a sort-of intermediary body. In addition to connecting and matching entrepreneurs with lenders who provide small business grants, the government-backed the loans.

The logic behind this is simple: without the federal government backing loans, small business grants would grind to a halt given expectations for many small business bankruptcies.

The true beauty of the PPP small business loans is they can be fully forgiven if certain criteria are met. One of the criteria is that at least 60% of the small business grant had to be allocated towards payroll costs.

Many of the largest banks, such as JPMorgan Chase, Bank of America, and TD Bank offered small business loans. The list of participating financial institutions also includes community banks, regional banks, and even non-traditional fintech companies like Square.

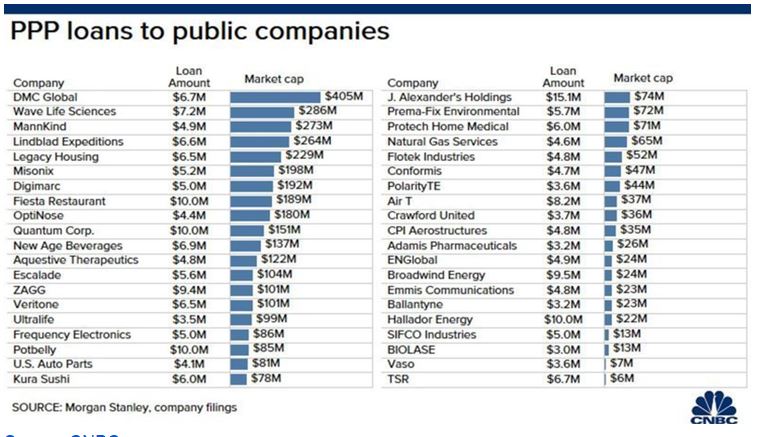

One of the biggest drawbacks of the original PPP loan under the Trump administration was the fact that very large companies had much easier access to funds that were meant for small business loans.

For example, Shake Shack is a New York Stock Exchange-listed multi-billion dollar burger chain. It was among the most criticized corporate giant tapping funds meant for small business grants.

In total, 370 public companies took advantage of money meant for small business loans.

Now, to say that billion-dollar companies were immune from the COVID-19 restrictions and hardships would be false. In Shake Shack’s case, the company had large rent bills to pay in New York City and many other cities but was not allowed to fill its restaurant with customers. In addition, delivery orders were subject to a third-party delivery fee that could have risen to as much as 30% of the value of the order.

From the public’s eye, public companies should have looked elsewhere to raise much-needed capital. Shake Shack ultimately returned the $10 million it borrowed and decided to sell up to $75 million worth of its own stock instead.

Chris Allieri, a communications specialist and founder of firm Mulberry & Astor told CNBC in early 2020:

“I’ll tell you today, on April 20, it doesn’t so much matter who returned the money and who didn’t,” Allieri said. “The point is that the application was made. There’s a broader problem in your brand — what are the actions that led to this application?”

JPMorgan was one of the thousands of lenders that took part in the PPP in 2020. During the early stages of the small business loan process, the mega Wall Street bank prioritized its mega-clients.

JPMorgan acknowledged that most of its commercial banking clients (i.e public companies) that applied for a loan received them. By comparison, just 6% of smaller customers from its less lucrative business banking unit were successful.

In fact, JPMorgan and other Wall Street banks were the subjects of a lawsuit on behalf of small businesses. The banks were accused of favoring their large clients at the expense of small business grants.

The new Biden administration, in reaction to small businesses getting the short-end of the PPP stick, introduced new rules for the latest round of PPP funding that opened in January 2021. The five main updates include:

Fortunately, public opinion is consistent across both sides of the political aisle that small businesses shouldn’t have to compete with mega corporations for a small business grant that they are entitled to.

The updates and changes introduced by the Biden administration to the PPP is one that few can find fault with.

America and its amazing community of small businesses deserve a fighting chance to survive and that is exactly what they are getting with the updated small business loans guidelines.